In the context of trading, here is how I would translate what Sherlock is trying to say.

Observation includes the following

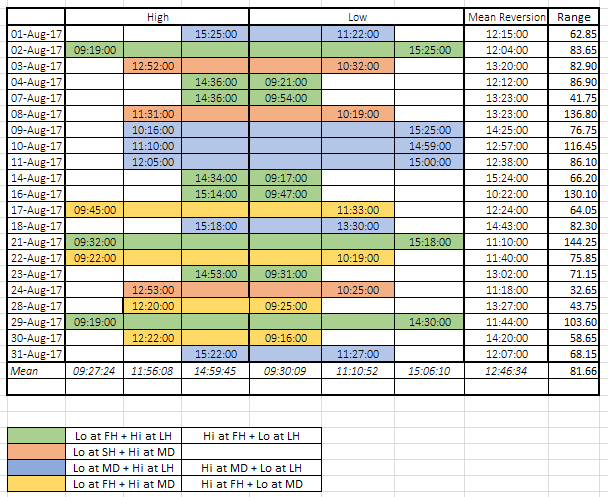

1) Capturing Statistical Data - When observing, are you looking at data elements like, time taken for the price to move from point A to B. A being a reference point, how many times does the price B get revisited, and things like this. While you are doing this the next point should also happen in the background.

2) Creating a Mental Baseline - After observing the charts for a few days, across the same reference points, you should be able to create mental baseline, for instance, If the price moves beyond this point, it does go up by X points on an average. This baseline would get refined over time, but this "program" has to be running in the background of you mind all the time.

Now that we hopefully have some idea of what does it mean to "Observe" lets looks at some ways to enhance the process of observation.

How to get better at Observing?

1. Focus - Imagine you had two tasks to choose from - a) To look at every passing vehicle on the road to see if it,s registration number starts with odd or even b) To look at every passing two wheeler and see if its registration number starts with odd or even?. In all probability your performance on the task (b) would be better. Same logic here. If you look at too many things, too many indexes or stocks, its difficult to observe something specific. The other side of focus is also distractions - It could be in the form of other people in the immediate environment, browsing something else, phone calls etc. That too needs to be controlled.

2. Perspective - Taking the same example as above imagine you are given two more choices now - a) To look at every passing two wheeler and see if its registration number starts with odd or even?. b) Sit in a control room and look for all the passing two wheelers, both from back and front - again in all probability your performance on the task (b) would be better. This is akin to watching both the CE and PE option strikes of an instrument. You can also build perspective by looking at the same instrument in different time frames, same instrument with different types of charts, for instance you can juxtapose both a foot-print chart a candlestick chart. Or may be a PnF chart and a Candlestick chart. The idea is to get multiple perspectives of the same instrument.

3. Technology - Well, here technology means, more screen real-estate. One of the reason a multi monitor set-up helps is it, helps you simultaneously view the price action, which is very different from flipping across tabs. It does not (at least to me) give the same visual perspective. Take at look at my set up below.