This is in continuation with the scalping set-ups series.

The first one being (https://www.niftyscalper.com/blogs/2017/11/8/nifty-scalping-set-ups-01-opening-spikes-opening-drive)

In this post we will look at the next most frequently occurring set-up (Close to 85 % of days). In the previous post we looked at Opening Spikes and Opening Drive, now this setup is the third play of the day.

1. What determines entry?

There are two key factors to consider when entering this trade

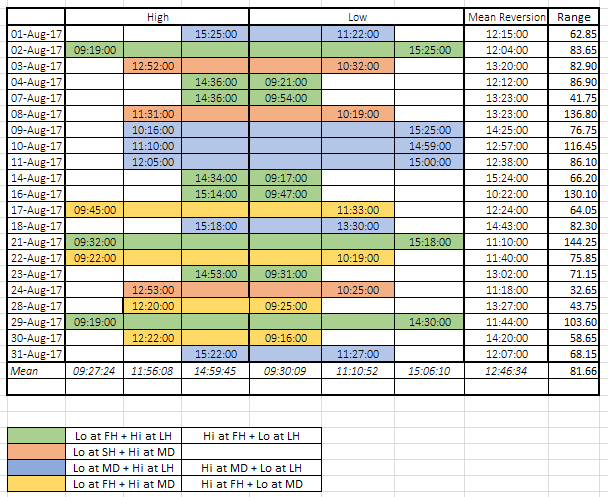

a) Range - Its recommended that you enter the trade once we cross the mean high low range for the pre europe open time segment. For instance this week the mean morning range has been 62.88 SD being 11.5.

b) Time Segment - Mean is again 11:52 (Hrs) SD being 44 minutes. So its good to attempt this play post 11:00 pm.

2. What is the probable - max favorable excursion - reward?

Since we are targeting the mean or the VWAP, we would need to consider where the low is. Typically it will be 25 to 35 points from the mean, so that is the path length that you are intending to capture. You should also factor in the usual time that it takes for price to traverse that length, which is around 1 hour. Please do note that we publish these figures for reference on a daily basis in the trading room. Have a look at the snapshot below.

3. What is the probable - max adverse excursion - risk? - Now that you know the possible target for your trade you can define the risk the way you prefer. Given the high probability of this setup you can have a fixed 1:2 risk reward and in an even where the stop loss does trigger you can re-enter again once the new low is formed.

4. Trade Management Approach - While a fixed R:R is one way, there are people who scale in and out as well, usually with a hedge on the opposite side. Of course that is a more aggressive way of playing this set-up.

On a closing note, I was surprised that this setup is pretty common in other indexes as well. Do have a quick read of the blog post below.

http://traderfeed.blogspot.in/2006/08/trading-by-mean-reversion.html