I have been a fan of Victor Niederhoffer for a long time. What a talented multifaceted man. If you are into trading or any kind of speculative business you've got to read his books.

I read this (https://www.newyorker.com/magazine/2007/10/15/the-blow-up-artist) article about him and thought of sharing some interesting snippets.

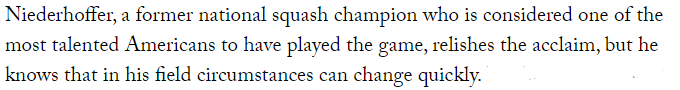

1. Experience in some sort of Performance Sport - I do think it helps to have had played a sport or done any performance related thing like Music etc. The reason I think its relevant is from a skill development perspective. All forms of sports or crafts require a progression of skill levels. It also requires us to observe, reflect, deconstruct, attempt and practice tasks.

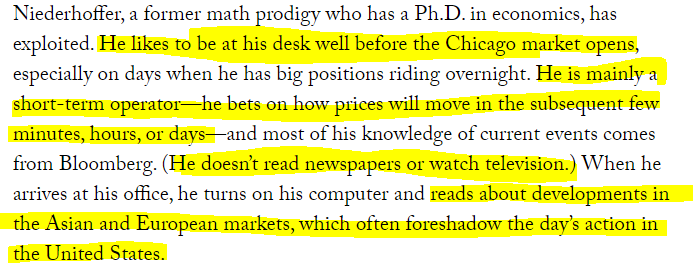

2. Discipline, avoiding noise and focusing on Short term moves - Being on time I guess is the first aspect of discipline, alludes to the idea of routines and their importance in success. The second aspect is avoiding noise, as a trader you need to have confidence in your system and approach and you need to avoid noise i.e informational noise. Thankfully I quit TV a decade back, and have never gone back. Lastly, look at that focus on "Short term moves". I have always been against the Random Walk/Fama school, and have been more of a Mandelbrot follower. Good to see the same beliefs at play here.

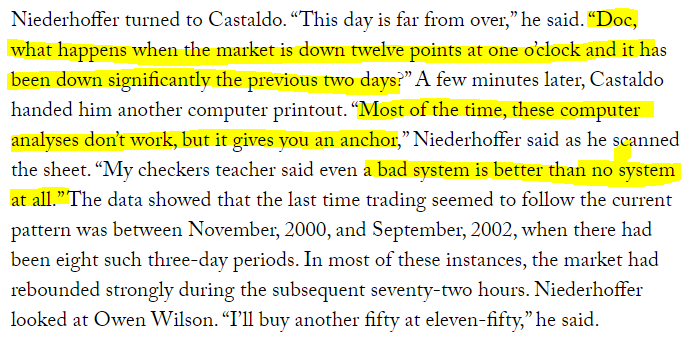

3. Market Statistics as an Anchor - It always helps to know how things worked in a similar context in the past. The reason it helps is because prices in the short term are nothing but a reflection of the emotions of people, and that does not change.

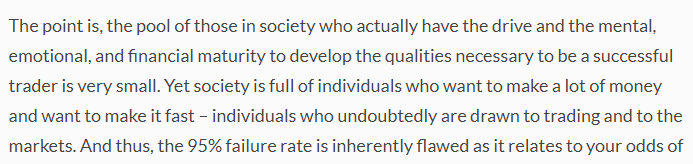

4. I told you so! If someone tells you that day trading does not work, its because most traders do not have the skills to make it work, but by itself patterns in shorter periods are far easy to predict than in longer periods.

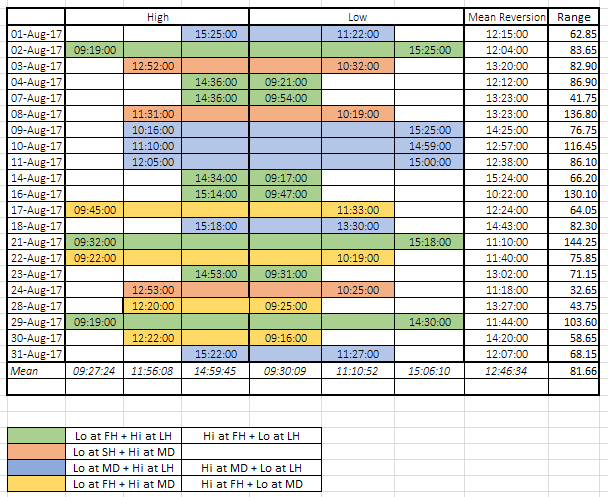

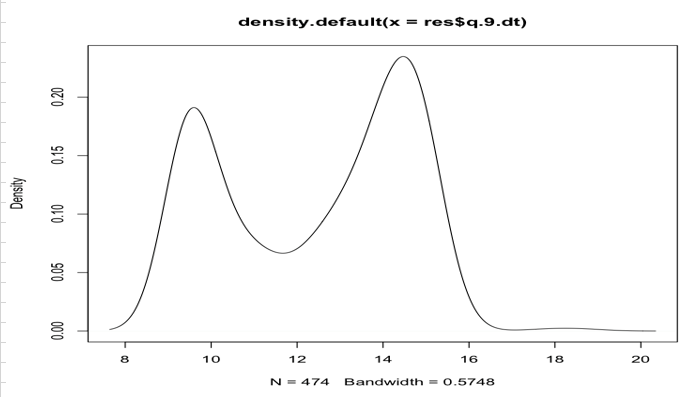

5. RIP - Efficient Market Hypothesis and Random Walk Theory - The moment you shorten your trading time frame, you will start to see the inefficiencies. If you are a trader reading this, think about Open Close as a separate event and High Low range formation as a different event, and you will see the inefficiencies clearly.

Lastly, understand where risk comes from, I mean risk of ruin. While there is always a defined risk with which we take trades, risk of ruin typically comes from the possibility of an unforeseen event happening and you having no control over it. Read that statement again, the second part especially.

Now think about how to avoid being in that situation, that should be good enough to keep you going in this business.

Happy Trading!