I am happy to let you know that we at NiftyScalper are taking the next step to bring the day trading community in India closer through our slack based NiftyScalper Trading Room.

In the past few months, the number of coaching requests were quite overwhelming, and it was taking too much of my time, on top of it I could focus only on 1 or 2 people at a time.

Also, I realized there were several people who could not afford my coaching offering, based on my interactions with a few people I realized, a Trading Room would be a much better way of bridging this gap.

So this is what I intend to offer in the room (From 6th Nov'17)

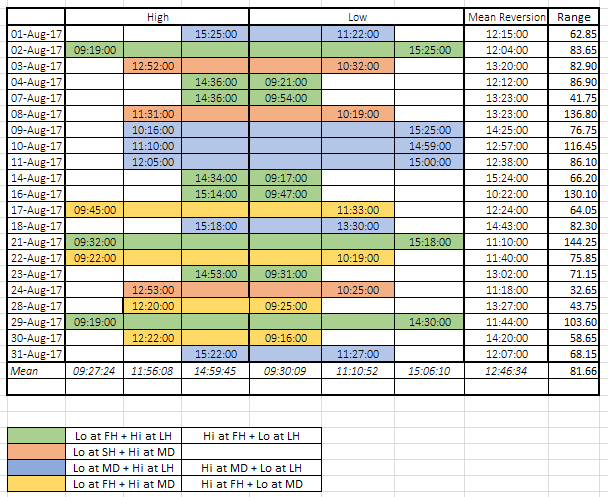

1. Live Trade Alerts - Yes its not easy to follow, but the idea is to learn from observing so that in future you don't have to depend on the alerts at all. These alerts also act as references for any questions that you may have. Apart from alerts, I also provide live observations on the developing market structure, which includes aspects like Range, Range expansion levels, Points of invalidation for positions, Mean reversion areas etc. Watching the market and the reading the updates would help budding traders connect the dots. Which over the long run would help traders develop an independent sense of the market.

Do note, that I do not use any proprietary indicators, or exclusive and expensive technologies like order-flow/footprint charts. I would perhaps share my rationale sometime soon on the blog as to why I don't see an edge in it. Nevertheless, whatever indicators and references that I use, are (almost) freely available to everyone.

2. Discuss Trade Rationale & anything else that wold help you become better at the game - Nothing like collectively discussing set-ups and clarifying by asking questions. I may not always be an expert at everything, the group over time will have several experts with different specializations, which would help you gather the wisdom of the crowds.

3. Discuss/Share Articles/Books - Learning should never end, and if its does, thats the end. With that perspective, the idea is to share and discuss best of the books and articles in the Day trading space

4. View Daily Performance Logs - They say, what gets measured gets managed, so the idea is to post our daily performance logs so that we know how we are doing. This is more from an indicative purpose. One may not be able to post all scalp trades, but we will post trades which can be predicted well in advance.

5. Specially curated blog posts and NIFTY data analysis reports only for members (after commercial launch) - There is a lot of effort and investment that goes into data analysis and related strategy formation, which is what would be shared with members. I also have data scientists on retainer contracts who help with testing various set-ups. All such data and reports would be available exclusively to the members.

The larger focus of the room will always be Quant/Statistics based scalping strategies.

Given that I would be hiring people to manage the room and other associated costs, this would be a paid service, however we would make sure the costs are pretty nominal. Initially till the end of 2017 the room would be run on a beta mode and would be free for you to access.

I am also working on creating a detailed glossary and faqs which would help you and others understand the #scalp-alert messages and other conversations better.

Look forward to your joining the slack group and would request you to type in a short intro (Location/Trading Exp./Etc.) about yourself in the #Intro channel once you join.

Please use the link below to join

https://join.slack.com/t/niftyscalper-tr/shared_invite/enQtMjgwODY4ODk2MzM5LTJlMDA0NDQ4N2UxYzY0N2IxMjM0YjNlYmNmNGVhZjliOTc4YzhjZmQ1MDEwM2VkODMyMDhhZjI2Mjc4ZTE3ZTE